INNOVATION

Hyperscale-Backed Cables Are Redrawing Asia-Pacific’s Data Map

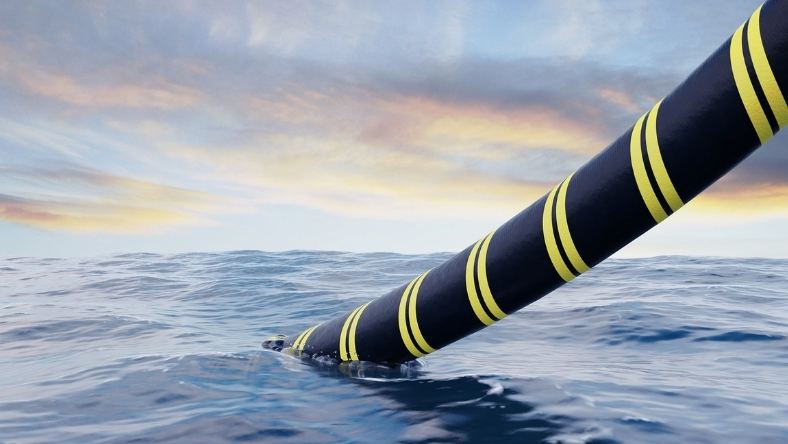

Hyperscale-backed subsea cable projects led by Meta are easing congestion and reshaping Asia-Pacific connectivity through targeted, shared infrastructure

9 Jan 2026

A shift is under way beneath the Asia-Pacific, where a limited number of hyperscale-backed subsea cable projects are beginning to reshape the region’s digital infrastructure.

For much of the past decade, internet traffic across Asia-Pacific has expanded faster than the undersea networks carrying it. Growth in video streaming, cloud computing and early artificial intelligence workloads placed increasing strain on ageing cable systems. Congestion became more frequent, while the risk of outages rose. Incremental upgrades proved insufficient.

The latest investment cycle reflects a change in strategy. Rather than extending legacy routes, major digital platforms are backing fewer but significantly larger cable systems designed to support traffic growth well into the next decade.

At the centre of this shift is Candle, Meta’s flagship subsea cable project. Due to enter service in 2028, the system will connect six Asia-Pacific economies and use advanced fibre-pair technology to expand capacity sharply. At the same time, enhancements to existing systems, including Bifrost, Echo and Apricot, are extending the life of key routes without the need for entirely new seabed paths.

Together, these projects signal a more deliberate approach to infrastructure investment. Hyperscalers are increasingly funding physical networks directly to secure long-term, scalable bandwidth, reducing reliance on leased capacity from telecom operators. Analysts say the focus is on resilience and flexibility, with more cautious claims on performance where technical details remain limited.

Reliability has become a priority. Recent cable faults in parts of Asia highlighted the vulnerability of single-route connections. By linking multiple countries and landing points, the new systems aim to reduce the risk that a single break disrupts several markets at once. Suppliers such as NEC say improved monitoring and fault-detection tools could cut repair times by more than half.

Regional telecom groups, including SoftBank, have joined some projects to secure stable international capacity and maintain influence as data demand accelerates. Ownership stakes also offer greater cost certainty in a competitive market.

Regulatory scrutiny and concerns from smaller operators persist. Even so, the direction is clear: a small number of large, hyperscale-backed cables are becoming the backbone of Asia-Pacific’s digital connectivity.

Latest News

25 Feb 2026

Beneath the Waves, Cables Learn to Think24 Feb 2026

TalayLink Bolsters Indo-Pacific Data Routes20 Feb 2026

I-AM Cable Raises the Bar for Regional Bandwidth19 Feb 2026

Tech Groups Deepen Asia-Pacific Cable Push

Related News

INNOVATION

25 Feb 2026

Beneath the Waves, Cables Learn to Think

PARTNERSHIPS

24 Feb 2026

TalayLink Bolsters Indo-Pacific Data Routes

INNOVATION

20 Feb 2026

I-AM Cable Raises the Bar for Regional Bandwidth

SUBSCRIBE FOR UPDATES

By submitting, you agree to receive email communications from the event organizers, including upcoming promotions and discounted tickets, news, and access to related events.