PARTNERSHIPS

Saipem and Subsea7 Merger Could Redraw Offshore Power Maps

Saipem and Subsea7 plan a merger that could reshape subsea energy and data projects, raising the stakes for rivals as approvals loom

6 Jan 2026

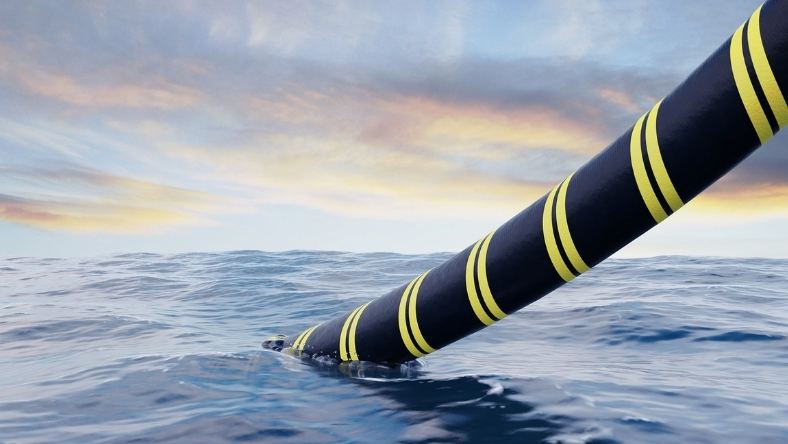

Something is shifting beneath the seabed. Saipem and Subsea7, veterans of offshore engineering, plan to merge in a deal that would create one of the world’s largest subsea construction firms. The aim is simple: to cope with a surge in demand for offshore power links and undersea data cables that modern economies increasingly depend on.

The tie-up, announced in mid-2025, has been agreed in principle and is due to close in the second half of 2026, subject to regulatory and shareholder approval. If completed, it would bring together two firms with long experience in designing and installing complex offshore systems. Their combined scale would allow them to bid for projects that are becoming larger, riskier and more interconnected.

That matters because offshore infrastructure has changed. Oil and gas platforms once stood largely alone. Today’s projects are networks. Wind farms must be linked to grids onshore. Countries want interconnectors to share power across borders. Data centres rely on ever more fibre-optic cables laid across oceans. Governments are pushing offshore wind hard; global data use keeps rising. Clients, faced with high costs and technical risk, increasingly prefer fewer contractors who can deliver end to end.

Saipem and Subsea7 argue that together they can do just that. A merged group would command a bigger fleet of specialised vessels, operate in more regions and offer deeper expertise across design, installation and commissioning. Executives talk of shared resources, simpler operations and the financial strength to take on the biggest jobs.

Analysts see broader effects. In fast-growing markets such as Asia-Pacific, a larger, integrated contractor could dominate major tenders, squeezing smaller rivals. For customers the attraction is convenience: one partner, one balance sheet, clearer accountability if things go wrong.

The risks are familiar. Regulators will examine the merger closely for competition concerns. Combining two complex organisations brings cultural and execution challenges. Integrating systems and teams will test management as much as winning new contracts.

Even so, the industry’s mood is cautiously optimistic. Offshore wind is expanding, data traffic is deepening its reach and resilient subsea infrastructure has become essential rather than optional. If the merger goes ahead, it would mark another step in the steady consolidation of an industry adapting to life beneath increasingly busy seas.

Latest News

20 Feb 2026

I-AM Cable Raises the Bar for Regional Bandwidth19 Feb 2026

Tech Groups Deepen Asia-Pacific Cable Push18 Feb 2026

AI and Cloud Ignite APAC’s Subsea Boom17 Feb 2026

du Announces Strategic Investment in SING Submarine Cable

Related News

INNOVATION

20 Feb 2026

I-AM Cable Raises the Bar for Regional Bandwidth

MARKET TRENDS

19 Feb 2026

Tech Groups Deepen Asia-Pacific Cable Push

TECHNOLOGY

18 Feb 2026

AI and Cloud Ignite APAC’s Subsea Boom

SUBSCRIBE FOR UPDATES

By submitting, you agree to receive email communications from the event organizers, including upcoming promotions and discounted tickets, news, and access to related events.